Real estate will be US. Because motels were not a listed permitted use in the residential district the STR was not allowed.

.jpg)

Financing And Leases Tax Treatment Acca Global

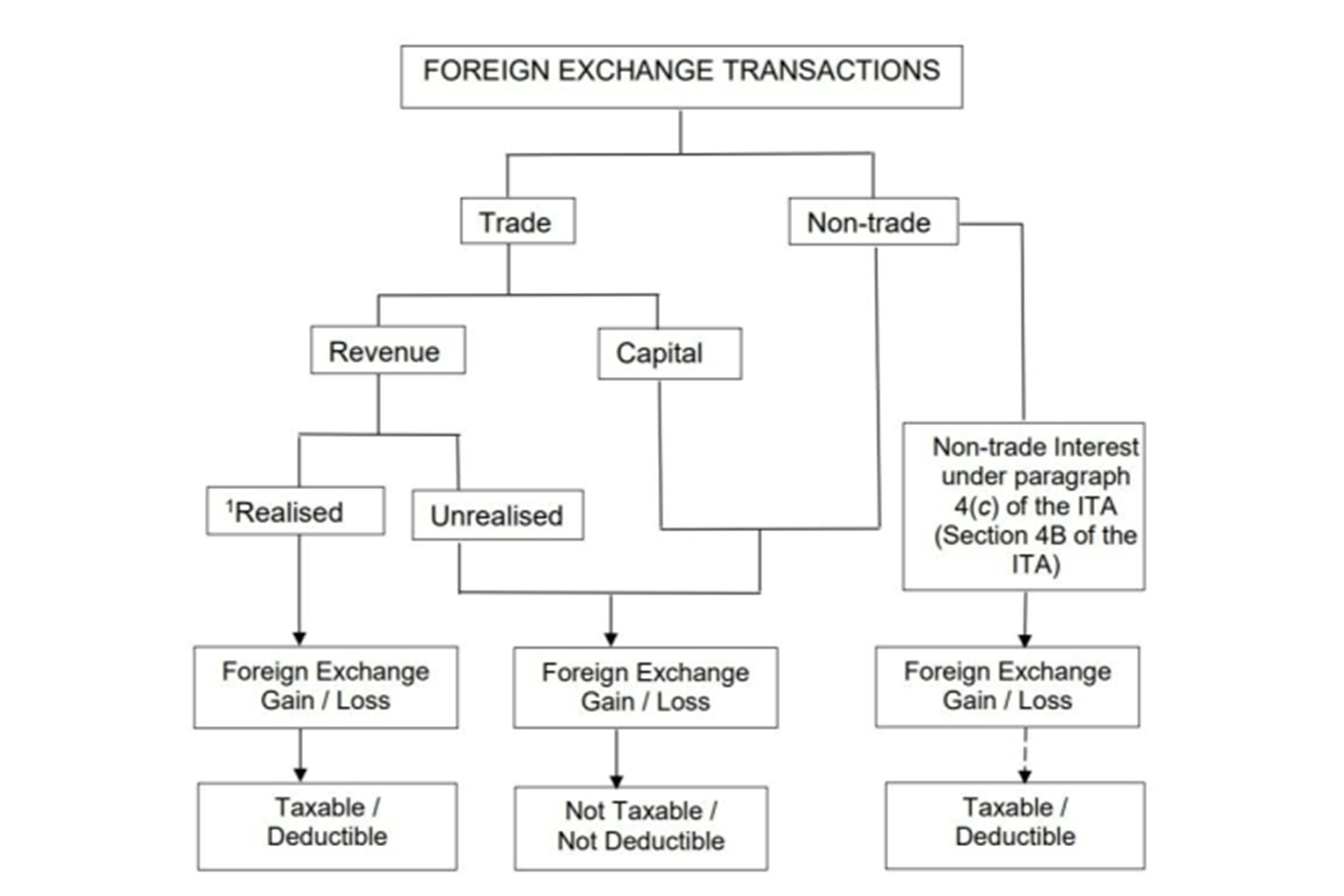

4 d if it is an investment income.

. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Where rental income is assessed under S4d rent received in advance is. This means that in 2022 youll be filing your taxes for YA 2021 that ends on 31 December 2021.

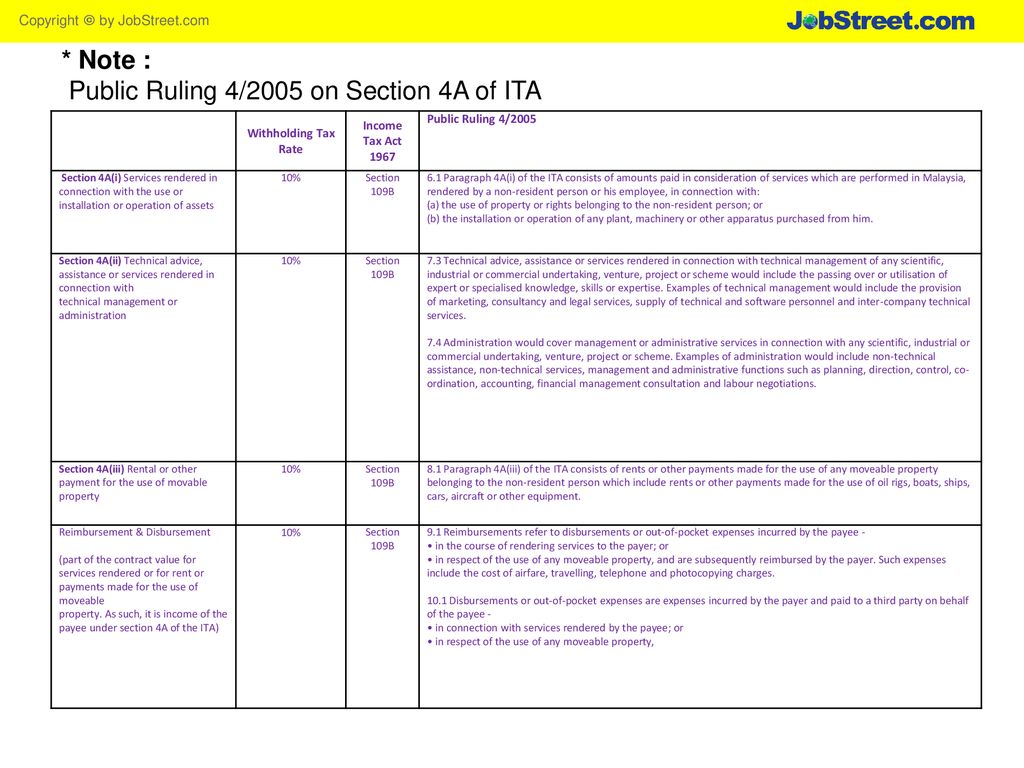

It replaces PR 42011 dated 10 March 2011 please refer to our e-CTIM No132011 dated. This rental income is US. For the purpose of this ruling the words used have the following meanings.

And b Letting of real property as a non-business source under paragraph 4dof the ITA. The Inland Revenue Board IRB has issued Public Ruling No. In general rental income derived from passive activity is excludable from unrelated business income reporting.

If you own an investment property and collect rent from your tenants its. Therefore any rental of US. The association will be taxed on the rental income derived from the letting out of part of its premise and the member will also be taxed on the income derived from operating a.

The Inland Revenue Board of Malaysia LHDNM issued Public Ruling PR No122018 Third Edition on 19 December 2018 reported in our e-CTIM TECH-DT 972018 dated 21 December 2018. As a general rule a non-US person who rents out his or her US home is subject to a 30 withholding tax imposed on the gross amount of each rental payment. 22 letting a property means.

The decision was reported in the. 12004 issued on 30 June 2004 provides clarification on. The letting of the house is a non-business source and the rental income is taxable under paragraph 4 d of the ITA.

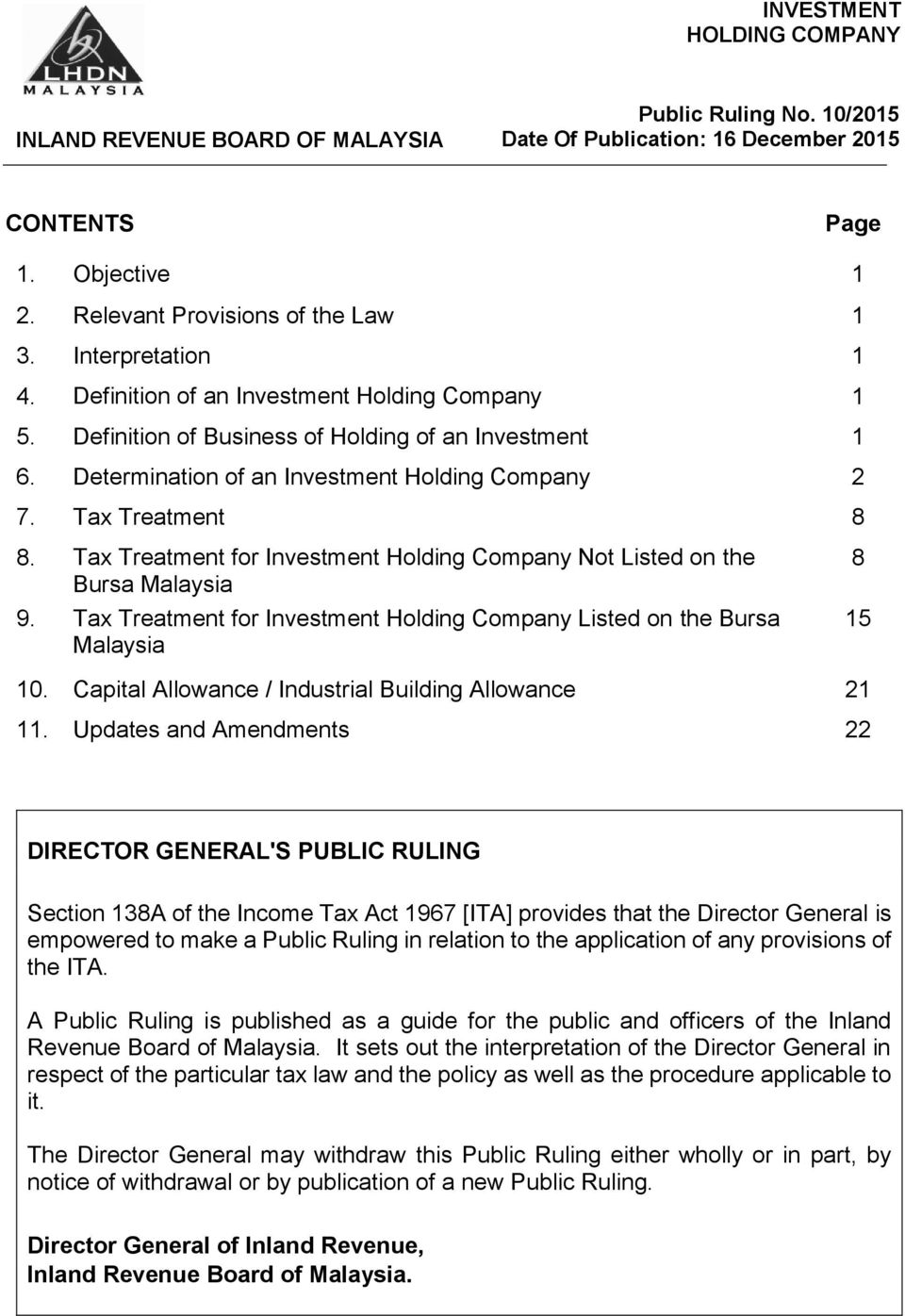

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. For a year is RM500 while quit rent is RM50 a year. Learn the five most important rules every income investor needs to know.

Capital Allowance 25 11. An exempt organization that was created by a chamber of commerce to encourage business development in a particular area obtained a mortgage to help finance the construction of a building that is leased to an industrial tenant at less than the fair rental value. GSTR GST ruling.

You sell the home for 400000 at the beginning of 2016. The Ability Center of Greater Toledo v. At issue was whether under the Fair Housing Acts accessibility requirements for newly.

Moline Builders et al. LETTING OF REAL PROPERTY. If you own an investment property and collect rent from your tenants its important to d.

4 a business income for company pr 122018. TD taxation determination short form ruling LCR law companion ruling. Leasing personal property such as cubicles and other equipment.

They express our interpretation of the laws we administer. Based on Public Ruling PR 122018 the rental income is considered to be a business income if you provide support or maintenance services comprehensively and actively to your property. Youll only be given a few months to file your income tax so be sure to keep all your payslips EA Forms and receipts as youll need them to file your taxes.

That the short-term rental of property fell within the Townships definition of a motel not a dwelling. In 2015 things change you move back out and rent the home once again. Public rulings are binding advice.

NRA obtains rental income from the rent of her condominium in the United States. 12 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 21 rent or rental income or income from letting includes any sum paid for the use or occupation of any property or part thereof including premiums and other payments in connection with the use or occupation of the property.

It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. Pages 16 This preview shows page 8 - 10 out of 16 pages. Course Title ACCOUNTING 1A.

A Ruling may be withdrawn either wholly or in. However the Supreme Court upheld the Court of Appeals ruling on an alternate basis. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

Industrial Building Allowance 28 12. Ohio On August 10 2020 the court issued an order granting partial summary judgment in favor of the plaintiffs and against the defendants in Ability Center et al. However there are specific types of rental income considered taxable by the Internal Revenue Service IRS.

As a rental property owner you routinely complete a number of reports related to your property and income. A Letting of real property as a business source under paragraph 4aof the Income Tax Act 1967 ITA. Leasing personal property with or without services.

The tax renewal liability is based on the prior years gross receipts. TR taxation ruling. At the end of 2014 the value of the home remains 400000.

Under LAMC Section 2143 LGR2 the rate is 127 per 100000 or fractional part there of. It must be provided by the owner himself or through hiring of. US Taxation of Rental Income Generally.

Any rental of personal property used in the United States will also be US. Rental Income Received in Advance 18 10. This PR which supersedes PR No.

Include rent from movable and immovable properties letting out land house commercial or residential properties letting out of ships plant machinery or motor vehicles classes of income sec. It sets out the interpretation of the. We publish many different types of public rulings.

Because the tax is based on the prior years gross receipts the tax liabilities for both the 1st. This means if a foreign person owns an Irvine California house and rents it out for 2000 a month 600 of each 2000 monthly rent payment payable. It sets out the interpretation of the Director General.

Replacement Cost of Furnishings 28 13. Letting of Part of Building Used in the Business 28. This R uling explains.

Further to the additional prihatin package announced by the government on 6 april 2020 which included the granting of a special tax deduction to building owners who provide a rental reduction of at least 30 to their small and medium enterprise sme tenants for the period from april 2020 to june 2020 the ministry of finance has via its. The annual tax renewal is due on the first date of January of each calendar year. The type of ruling is indicated in the title for example.

I letting of real property as a business source under paragraph 4a of the Income Tax Act 1967 ITA. According to the Public Ruling rental income can be treated as business sources. Taxpayers can have their rental income to be.

Income from Letting of Real Property. Rental income related to exempt purpose. According to the public ruling rental income can be.

The provisions of the ITA related to.

Inland Revenue Board Of Malaysia Qualifying Expenditure And Computation Of Capital Allowances Public Ruling No 6 Pdf Free Download

8 Things To Know When Declaring Rental Income To Lhdn

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

Five Public Rulings Updated And One New Public Ruling Issued By The Inland Revenue Board Ey Malaysia

Inland Revenue Board Of Malaysia Investment Holding Company Pdf Free Download

Pr Po Process Flow By Jace Cheah Ppt Download

Pr Ihc Public Ruling Of Ihc Inland Revenue Board Of Malaysia Translation From The Original Studocu

Public Ruling Irb Inland Revenue Board Of Malaysia Translation From The Original Bahasa Malaysia Studocu

Special Tax Deduction On Rental Reduction

.jpg)

Financing And Leases Tax Treatment Acca Global

Public Ruling 2018 12 Income From Letting Of Real Property Inland Revenue Board Of Malaysia Studocu